The smart Trick of Offshore Account That Nobody is Talking About

Table of ContentsNot known Details About Offshore Account Offshore Account Fundamentals ExplainedRumored Buzz on Offshore AccountIndicators on Offshore Account You Should Know

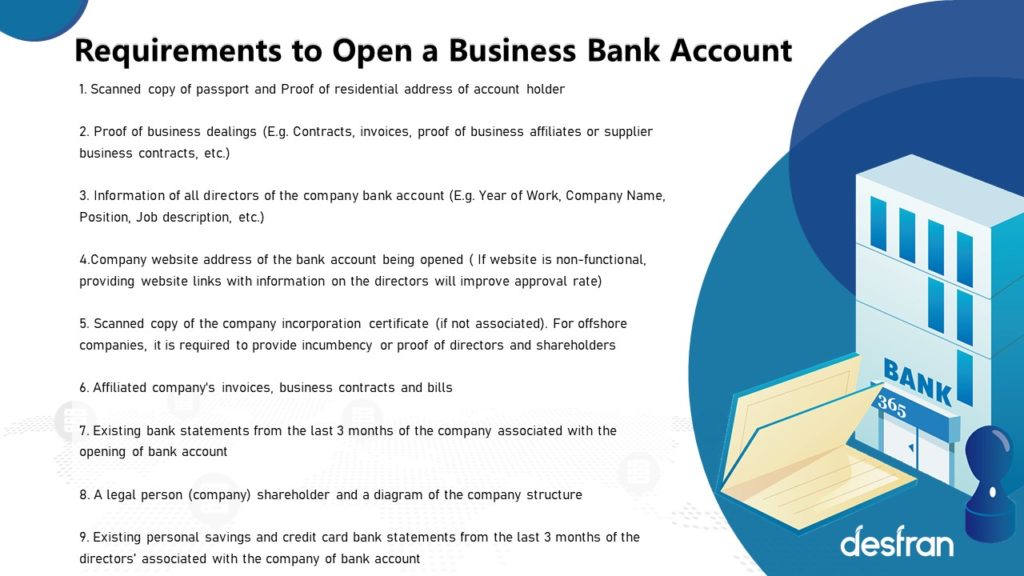

Two common mistaken beliefs concerning offshore financial are that it is illegal and that it is only for the super-wealthy. As a deportee you can use overseas banking lawfully as well as to your benefit.An overseas checking account is frequently used by those who have little confidence in their neighborhood financial sector or economic situation, those who live in a much less politically steady nation, those who can legitimately avoid tax in their brand-new country by not remitting funds to it, and deportees that desire one centralised financial institution account resource for their international monetary demands.

Keeping a savings account in a country of domicile makes substantial and also long-lasting sense for several migrants. Unless you're attempting to transform your country of residence and sever all ties with your residence nation forever, maintaining a financial presence there will certainly suggest that if ever you desire to repatriate, the path will certainly be smoother for you.

Your employer might require you have such an account into which your income can be paid each month. You may additionally need such an account to have actually energies linked to your new residential property, to obtain a smart phone, rent a house, increase a home mortgage or buy a vehicle.

Offshore Account Can Be Fun For Everyone

The main point to bear in mind is that overseas financial isn't always a best solution for each expat. It is necessary to recognize what advantages and also drawbacks offshore financial has as well as just how it fits in your personal scenario. To aid you choose whether an offshore bank account is right for you, here are one of the most popular advantages as well as drawbacks of offshore financial.

If the nation in which you live has a less than beneficial financial environment, by maintaining your riches in an overseas bank account you can avoid the threats in your brand-new country such as high rising cost of living, currency devaluation and even a coup or war. For those deportees residing in a country where you only pay tax obligation on the money you remit into that nation, there is an evident tax obligation advantage to maintaining your money in an overseas checking account.

Expats can take advantage of this despite where they are in the globe as it can indicate they can access their funds from ATMs or online or over the phone any time of the day or evening, whatever the time zone. Any type of rate of interest gained is typically paid without the deduction of tax.

What Does Offshore Account Do?

Note: specialist estate preparation suggestions requires to be sought by anybody looking for to gain from such a benefit. Some offshore banks charge less as well as some pay more rate of interest than onshore financial institutions. This is coming to be much less and less the case nowadays, however it deserves looking very closely at what's available when seeking to establish a new overseas savings account. offshore visit this page account.

Much less government treatment in overseas monetary centres can indicate that offshore financial institutions are able to use even more intriguing investment services and also remedies to their customers. You might take advantage of having a connection supervisor or exclusive financial institution account manager if you choose a premier or exclusive offshore savings account. Such a solution is of advantage to those that want an even more hands-on technique to their account's administration from their financial institution.

and allow you to wait for a particular price prior to making the transfer. Historically financial offshore is probably riskier than banking onshore. This is demonstrated when examining the after effects from the Kaupthing Singer as well as Friedlander collapse on the Island of Male. Those onshore in the UK who were influenced in your area by the nationalisation of the financial institution's moms and dad business in Iceland got complete payment.

The term 'offshore' has become associated with prohibited as well as immoral cash laundering as well as tax obligation evasion task. Therefore understandably anybody with an overseas bank account could be tarred, by some, with the exact same brush although their overseas banking activity is completely reputable (offshore account). You need to select your overseas jurisdiction carefully.

The Facts About Offshore Account Uncovered

Additionally, some offshore sanctuaries are less steady than others. It is essential to take a look at the terms of an offshore checking account. Will you be charged greater charges if you fail to keep a minimum equilibrium, what are the fees and fees for the account and also the services you may wish to utilise? It can be harder to resolve any type of problems that may arise with your account if you hold it offshore.

And also as well as abiding with these durable criteria, expats may still be able toenjoy more privacy from an offshore bank than they can from an onshore one. useful content This factor alone is sufficient for several people to open an offshore financial institution account. There can be expat tax benefits to making use of an offshore financial institution -but whether these her comment is here apply in your case will depend on your individual situations, such as nation of residence.